Our Mission:

To produce attractive risk-adjusted returns for our clients at a compelling value

Tallwoods Partners was founded as an investment office to manage both our capital and yours and is designed to invest like the best, most sophisticated investment firms. As a boutique multi-family investment office, we have no bureaucracy or big-firm conflicts. Instead, we focus on managing money and meeting your goals.

Our founders consist of respected investors with significant investment and portfolio management experience. Their network and experience managing endowments, pensions, family offices, and hedge funds help them find and evaluate public and private investment opportunities.

Customized Personal Service

At Tallwoods, we invest time upfront getting to know you and understanding your entire financial picture. We utilize dynamic asset allocation, fundamental research, and high-quality third-party investment managers and products across a broad range of traditional and alternative strategies to construct customized portfolios that are designed to deliver an after-tax risk-return profile that meets your objectives.

Focused, Personal Attention

At Tallwoods Partners, we use our expertise with alternative strategies and managers to generate less correlated returns and to better protect capital. Our client portfolios might be different than the standard ones, but these are always constructed to be thoughtful and sound.

We will work with you to navigate through the financial, legal, family, and personal complexities that often come with managing wealth. Our goal is better bottom-line returns. Let us create an investment portfolio designed to meet your unique circumstances and make sure that it integrates all aspects of your life. These include:

When it comes to wealth management, we have the experience, expertise, and confidence to think independently. We do not necessarily follow the crowd.

Consolidated Reporting For A Clear Financial Picture

We aggregate all of your financial information and present it in a clear, actionable format.

We can serve as the quarterback and central point of contact for industry-leading service providers – e.g., custodians, investment managers, accountants, lawyers, and estate planners – so that we can coordinate all of your investment activities to integrate your portfolio with your financial plan.

Dynamic Portfolio

Investment portfolios must be responsive to your changing needs and changing market environments. Asset allocation is the primary driver of portfolio returns. By integrating your overall financial objectives with the market environment, we can implement intelligent allocation and investment decisions.

Capital Preservation

Our staff understands that limiting losses is critical to long-term compounded growth. We endeavor to construct portfolios that are designed to preserve capital in even the most difficult economic environments.

Alternative Assets

Non-traditional strategies and managers can play a valuable role. Our team believes that alternative assets can provide less correlated returns with a more tailored risk-return profile when used properly.

Diversification

We know how difficult it is to make predictions, especially about the future. Our portfolios are not based upon confidence in any one economic forecast, but consider a wide range of possible scenarios. Diversification protects against the inability to know which of a variety of scenarios will play out.

Costs Matter

Managing costs is critical and controllable. That is why we pay careful attention to costs relative to the value added by high fee products and managers. In addition, we leverage our relationships to negotiate lower fees and more favorable terms when possible.

Taxes Matter

At Tallwoods Partners, we believe that what you keep is all that matters. Our team focuses on net after-tax returns with an emphasis on, and sensitivity to, tax considerations. We actively rebalance portfolios to minimize tax liabilities.

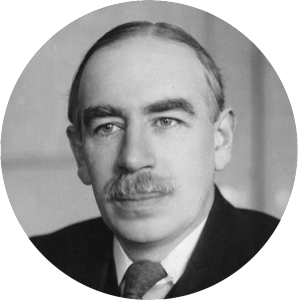

"Finally it is the long-term investor, … who will in practice come in for most criticism, wherever investment funds are managed by committees or boards or banks. For it is in the essence of his behavior that he should be eccentric, unconventional, and rash in the eyes of average opinion. If he is successful, that will only confirm the general belief in his rashness; and if in the short run he is unsuccessful, which is very likely, he will not receive much mercy. Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally." — J.M. Keynes, Chapter 12, The General Theory of Employment, Interest, and Money